profhimservice53.ru Community

Community

Gov Digital Currency

[House Hearing, Congress] [From the U.S. Government Publishing Office] THE PROMISES AND PERILS OF CENTRAL BANK DIGITAL CURRENCIES. The project will focus on developing digital currencies financial literacy materials and assessing how a digital economy can be used for the benefit of the. Digital currency includes sovereign cryptocurrency, virtual currency (non-fiat), and a digital representation of fiat currency. Virtual currencies are a kind of electronic money. That means when you buy a virtual currency you don't get an actual coin or bill that you can hold in your. What would a U.S. central bank digital currency (CBDC) be? Learn more about the future of a digital dollar and how it would differ from cryptocurrency. The term includes a digital currency, a digital medium of exchange, or a digital monetary unit of account issued by the United States Federal Reserve System, a. How will OFAC use its existing authorities to sanction those who use digital currencies for illicit purposes? The United States' whole-of-government strategies. Cryptocurrency transactions will typically be recorded on a public ledger, called a “blockchain.” That's a public list of every cryptocurrency transaction —. The Reserve Bank is actively researching central bank digital currency (CBDC) as a complement to existing forms of money. Brad Jones, Assistant Governor . [House Hearing, Congress] [From the U.S. Government Publishing Office] THE PROMISES AND PERILS OF CENTRAL BANK DIGITAL CURRENCIES. The project will focus on developing digital currencies financial literacy materials and assessing how a digital economy can be used for the benefit of the. Digital currency includes sovereign cryptocurrency, virtual currency (non-fiat), and a digital representation of fiat currency. Virtual currencies are a kind of electronic money. That means when you buy a virtual currency you don't get an actual coin or bill that you can hold in your. What would a U.S. central bank digital currency (CBDC) be? Learn more about the future of a digital dollar and how it would differ from cryptocurrency. The term includes a digital currency, a digital medium of exchange, or a digital monetary unit of account issued by the United States Federal Reserve System, a. How will OFAC use its existing authorities to sanction those who use digital currencies for illicit purposes? The United States' whole-of-government strategies. Cryptocurrency transactions will typically be recorded on a public ledger, called a “blockchain.” That's a public list of every cryptocurrency transaction —. The Reserve Bank is actively researching central bank digital currency (CBDC) as a complement to existing forms of money. Brad Jones, Assistant Governor .

Digital Assets. Today, fintech is driving innovation in financial markets across the globe. New technologies are wide-ranging in scope, from cloud computing. [House Hearing, Congress] [From the U.S. Government Publishing Office] THE FUTURE OF MONEY: DIGITAL CURRENCY. A central bank digital currency (CBDC) is money that a country's central bank can issue in digital (or electronic) form, rather than as physical money, such as. We are not completely adverse to a UK Central Bank Digital Currency (CBDC) scheme, however, we don't believe a CBDC should be “programmable”. While the Reserve Bank has not yet made a decision on whether to issue a CBDC, the Governor noted in his speech 'Payments: The Future?' that: the RBA. For purposes of OFAC sanctions programs, what do the terms "digital currency," "digital currency wallet," "digital currency address," and ". The following materials are helpful tools for consumers and bankers to understand virtual currency. June 10, Authority of Texas State-Chartered Banks. Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. A report on Central Bank Digital Currencies (CBDC) with a final overall conclusion regarding its issuance in UK. The OCC's focus in the financial technology area includes matters involving bank-fintech arrangements, artificial intelligence, digital assets and tokenization. Federal government websites often end profhimservice53.ru profhimservice53.ru Before sharing Digital currency includes sovereign cryptocurrency, virtual currency (non. Since then under that “BitLicense” regulation or the limited purpose trust company provisions of the New York Banking Law, DFS has granted numerous virtual. For example, digital assets include cryptocurrencies, stablecoins and nationally backed central bank digital currencies. Regardless of the label used, or. Companies and individuals are increasingly considering initial coin offerings (ICOs) as a way to raise capital or participate in investment opportunities. Prohibits a governmental body (defined as the state or a state agency) from: (1) accepting payment made with a central bank digital currency. Central Bank Digital Currencies are a new form of electronic money that, unlike well-known cryptocurrencies, are issued by central banks of certain. Digital financial services represent a new approach to financial inclusion — they give poor families access to an array of affordable resources that make. Licensing requirements for digital currency trading and custody services and certain liquidity services – March 2, Opinion Licensing. DIGITAL CURRENCY MODIFICATIONS GENERAL SESSION STATE OF UTAH Chief Sponsor: Tyler Clancy Senate Sponsor: Michael S. Kennedy Cosponsor: Joseph Elison. We're exploring the possibility of issuing a digital form of the Canadian dollar, also known as a central bank digital currency (CBDC). Find out what a Digital.

Fractional Trades Fidelity

It will launch real-time fractional share trading for stocks and ETFs for wealth management firms. Most of brokerage houses that offer fractional share also offer commission-free trading. Fidelity both offer options with fractional shares. ETFs are. Sometimes fractional purchases involve NFS submitting an order to the market, sometimes NFS already owns a partial interest in a share and sells. A Fidelity spokesperson was not available for an interview. In the U.S., demand for fractional ETF trading has been high because ETF unit prices are higher than. US Fractional Shares Available1. E-Trade, 0. Fidelity, 7,, +. IBKR, 10,, +. Schwab, [1] Fractional shares available for purchase as of June 16, Introducing fractional shares trading for all Fidelity customers using the Fidelity Mobile® App. Trade U.S. stocks or ETFs online. Fractional Trading supports market and limit orders only for fractional share quantities of a security that are good for that day's trading session, or in the. Why trade stocks with Fidelity? · $0 commission for online U.S. stock trades · Trading anytime, anywhere to stay connected to the markets and your investments. However, Fidelity offers fractional shares, letting you invest with literally as little as $1. And unlike some trading firms that offer fractional shares only. It will launch real-time fractional share trading for stocks and ETFs for wealth management firms. Most of brokerage houses that offer fractional share also offer commission-free trading. Fidelity both offer options with fractional shares. ETFs are. Sometimes fractional purchases involve NFS submitting an order to the market, sometimes NFS already owns a partial interest in a share and sells. A Fidelity spokesperson was not available for an interview. In the U.S., demand for fractional ETF trading has been high because ETF unit prices are higher than. US Fractional Shares Available1. E-Trade, 0. Fidelity, 7,, +. IBKR, 10,, +. Schwab, [1] Fractional shares available for purchase as of June 16, Introducing fractional shares trading for all Fidelity customers using the Fidelity Mobile® App. Trade U.S. stocks or ETFs online. Fractional Trading supports market and limit orders only for fractional share quantities of a security that are good for that day's trading session, or in the. Why trade stocks with Fidelity? · $0 commission for online U.S. stock trades · Trading anytime, anywhere to stay connected to the markets and your investments. However, Fidelity offers fractional shares, letting you invest with literally as little as $1. And unlike some trading firms that offer fractional shares only.

Relatively high broker-assisted trade fee. Why We Like It. Fidelity is one of the largest and most well-established brokerages, and it. trade. For more Additional Resources: Fidelity's Fractional Shares page offers a comprehensive explanation: [Fidelity fractional. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. How to Buy Fractional Shares and Reinvest Dividends with Fidelity How to Swing Trade Stocks (THE BASICS). Jake Broe · · What Type of. Step 1: Open a Fidelity Account · Step 2: Log in to Your Fidelity Account · Step 3: Click the “Trade” Tab · Step 4: Change the Setting From “Shares” to “Dollars”. Invest at a firm invested in you. Fidelity's secure and easy-to-use award-winning app gives you access to a broad choice of investments, expert insights. Plus, get commission-free trades for US stocks, ETFs, and fractional shares for as little as $1. All-in-one app: Deposit checks, pay bills, track spending. In fact, if you're interested in buying stocks or ETFs at Fidelity, you can invest in fractional shares with as little as $1. How do I get started trading? U.S. retail brokerage accounts increased from 59 million in to 95 million in Fidelity alone had million accounts in , with Charles Schwab. Introducing real-time trading of fractional shares of stocks and ETFs for our retail customers using the Fidelity Mobile® app. With fractional share trading, typically, $1 or $5. Trades executed: Once per day, after market close, Throughout the trading day and during extended. Brokers where you can trade fractional shares allow you to buy just a tiny fraction of an otherwise expensive stock - sometimes as small as $1. So for your $ Fidelity Investments stands out for its user-friendly interface that allows investors to easily purchase and trade fractional shares of top companies without. A fractional share is anything less than a full share in a publicly-traded company Fidelity Investments. Other brokerages have since entered this. US Fractional Shares Available1. E-Trade, 0. Fidelity, 7,, +. IBKR, 10,, +. Schwab, [1] Fractional shares available for purchase as of June 16, Trade any amount. Buy US stocks and ETFs for as little as $1 with fractional shares. Get an edge. Our intelligent. fractional shares trading. Later, in January , Fidelity announced that it would offer fractional shares trading for stocks and ETFs. Related Readings. Instead of buying a whole share of stock, you can buy a fractional share, which trades placed directly on a foreign exchange or in the Canadian market. Can I buy fractional shares at Fidelity International as of July ? No, fractional shares are not available at Fidelity International. Check out our best. Fidelity Investments. At Fidelity, you can start with as little as $1 when you buy fractional shares of iShares ETFs. · Online Brokerage Account. Buy iShares.

When Should You Start Investing In Stocks

One can start investing at any age. Stock market falls once in every 8 years so if you can learn technical analysis or fundamental analysis in. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been. Investing when you are young can make it easier to achieve your financial goals. Explore main asset classes, how to set clear goals, and more. Today's cash yields won't last forever. Stocks could push toward new highs, and higher yields can be locked in. Investing when you are young can make it easier to achieve your financial goals. Explore main asset classes, how to set clear goals, and more. Stocks can be particularly appealing to younger investors for a number of reasons. For one, you have more time to recoup potential losses. This article from. Don't start by asking "What should I invest in?" Instead, start by asking, "What am I investing for?" Many people start off by investing for retirement. Time is one of the most important factors in investing. The longer you invest for, the more opportunity there is to benefit from the stock market's long-term. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because. One can start investing at any age. Stock market falls once in every 8 years so if you can learn technical analysis or fundamental analysis in. What do I know about the stock market? Am I going to lose my money? What's the difference between a stock and a bond anyway? The fact is, if you've been. Investing when you are young can make it easier to achieve your financial goals. Explore main asset classes, how to set clear goals, and more. Today's cash yields won't last forever. Stocks could push toward new highs, and higher yields can be locked in. Investing when you are young can make it easier to achieve your financial goals. Explore main asset classes, how to set clear goals, and more. Stocks can be particularly appealing to younger investors for a number of reasons. For one, you have more time to recoup potential losses. This article from. Don't start by asking "What should I invest in?" Instead, start by asking, "What am I investing for?" Many people start off by investing for retirement. Time is one of the most important factors in investing. The longer you invest for, the more opportunity there is to benefit from the stock market's long-term. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because.

Before you put your money into the stock market or other investments, you'll need a basic understanding of. Stocks can be particularly appealing to younger investors for a number of reasons. For one, you have more time to recoup potential losses. This article from. 5 warning signs that you're not ready to start investing, according to financial planners · 1. You haven't thought about your priorities · 2. You have a lot of. How to Start Investing in Stocks in · Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. Don't start by asking, "What should I invest in?" Instead, start by asking, "What am I investing for?" Many people start off by investing for retirement. For example, the thumb rule for investing in equity is – your age. That is, if you are 30, then you can invest 70% in equities and the rest in fixed-income. They rarely pay dividends and investors buy them in the hope of capital appreciation. A start-up technology company is likely to be a growth stock. Income. A first step is thinking through your investment goals, time horizon, and ability to handle risk. This is key, as any investment involves some risk of losing. ALWAYS remember the five golden rules of investing: · The greater return you want, the more risk you'll usually have to accept. · Don't put all your eggs in one. Some investors are tempted to wait for the "right" moment to invest. But starting early, and regularly investing what you can, usually takes you a lot further. Start investing early and consistently, and have realistic expectations of your investments. · You can take a long-term view toward investing without needing to. The first step of how to start investing in the stock market is easy enough. Before you buy your first stock, you have to have an account to hold it. 1. Create a spending plan. · 2. Get educated. · 3. Start saving and investing today. · 4. Build a diversified portfolio based on growth. · 5. Keep it simple, and. To start investing in stocks, you would find a company that you like and think might grow in value and then purchase its stock through a brokerage account. Discover how Edward Jones selects stocks to recommend and the benefits of investing in the stock market. Start your financial journey today. Starting a business allows you to earn active income, while investing in the stock market allows you to earn passive income. Investors learning how to invest in the stock market might ask when to invest. Knowing when to invest, however, isn't as important as how long you stay invested. This step-by-step guide is designed to help you make well-informed decisions and invest in the stock market with confidence – from the get-go. When you're at different stages of your life, you will likely have different investment goals. When you're young and have most of your earnings years ahead, you.

Fl Wind Insurance

Wind Only Residential Insurance helps to protect you from financial loss due to hail and wind storms in Florida. If your Florida property has been damaged by the wind, your homeowners insurance policy should cover repair or replacement costs. However, there could be. Florida is known for extreme weather. Let the professionals at Harry Levine Insurance make sure you have the wind insurance that you need. Following Hurricane Andrew, Florida passed a law requiring insurance companies to offer their customers discounts and credits for existing building features and. The Florida Statutes · (1) It is the intent of the Legislature that insurers provide savings to consumers who install or implement windstorm damage. A wind mitigation is an inspection conducted by a Florida-licensed professional that examines the home's safety features. (1) An insurer issuing a residential property insurance policy must provide windstorm coverage. Except as provided in paragraph (2)(c), this section does. Florida wind insurance renewal increased %. We live in an 8 unit condo and just found out our wind insurance is going up over %. This will. Floridian Coastline Insurance offers windstorm insurance in Fort Lauderdale, Miami, Boca Raton, West Palm Beach & across Florida. Get a free quote today! Wind Only Residential Insurance helps to protect you from financial loss due to hail and wind storms in Florida. If your Florida property has been damaged by the wind, your homeowners insurance policy should cover repair or replacement costs. However, there could be. Florida is known for extreme weather. Let the professionals at Harry Levine Insurance make sure you have the wind insurance that you need. Following Hurricane Andrew, Florida passed a law requiring insurance companies to offer their customers discounts and credits for existing building features and. The Florida Statutes · (1) It is the intent of the Legislature that insurers provide savings to consumers who install or implement windstorm damage. A wind mitigation is an inspection conducted by a Florida-licensed professional that examines the home's safety features. (1) An insurer issuing a residential property insurance policy must provide windstorm coverage. Except as provided in paragraph (2)(c), this section does. Florida wind insurance renewal increased %. We live in an 8 unit condo and just found out our wind insurance is going up over %. This will. Floridian Coastline Insurance offers windstorm insurance in Fort Lauderdale, Miami, Boca Raton, West Palm Beach & across Florida. Get a free quote today!

Windstorm insurance, also known as wind and hail insurance, is a type of property insurance that provides coverage for damage caused by windstorms and. Hurricane coverage is part of your homeowners insurance in Florida; it's not a separate policy. You pay a single premium for your standard home insurance. By law, insurance policies covering properties in Florida must cover damage caused by wind during a hurricane (Florida Statutes § ). Florida Wind Coverage. Please note this map only shows our appetite for wind and hail in Tiers I and II in this state. To address the needs of the small to. If you have property in Florida and would like to get a quote: Call Monday to Friday, a.m. to p.m. Central Time. The program was created to strengthen Florida homes against hurricanes and save homeowners money. The program consists of two primary components: Wind. By Florida law, any homeowner with wind and hurricane-resistant features is entitled to wind mitigation credits, enabling them to receive a discounted insurance. The short answer is yes, you can buy home insurance without windstorm coverage in Florida. Find out more details in the article from Kin Insurance. Key Features · Coverage B 30% of Coverage A · Coverage C 70% of Coverage A · Coverage D 30% of Coverage A. The wind mitigation inspection form may be handed in to a home owner's insurance agency in order to receive Florida home insurance credits and discounts. The average cost for a windstorm insurance policy in Florida is between $1, and $2, per year. However, this number can change depending on the factors. All insurance companies must offer hurricane deductible options of $, 2 percent, 5 percent, or 10 percent of the policy dwelling or structure limits. The state of Florida requires insurance companies to offer discounts for protecting your home and mitigating damage that may be caused by hurricane-force winds. The wind mitigation inspection form may be handed in to a home owner's insurance agency in order to receive Florida home insurance credits and discounts. By Florida law, any homeowner with wind and hurricane-resistant features is entitled to wind mitigation credits, enabling them to receive a discounted insurance. This online tool provides homeowners and builders with a general indication of the types of wind insurance savings available from Florida insurance companies. Carriers may provide policy discounts and credits per Florida Statute upon receipt of a Wind/Roof Mitigation report. The report must detail the reinforcements. Although the company requested a percent increase on standard home insurance policies, the Florida OIR approved a percent increase. While percent. The "Windstorm Loss Reduction Credits" shows the range of wind premium credits for existing construction on a single family residence according to Section. Windstorm insurance can cover both the outside buildings and main structure of your property, as well as the inside contents. Windstorm coverage may not be.

How To Have A Roth Ira

Those who have savings in a tax-deferred account, like a traditional IRA, can convert some or all of that balance to a Roth IRA and pay ordinary income tax on. By investing in a Roth IRA, you won't pay taxes on potential earnings and can enjoy the freedom of withdrawing your money in retirement without worrying about. With a Roth IRA, you contribute money that's already been taxed (that is, "after-tax" dollars). Any earnings in a Roth IRA have the potential to grow tax. Roth IRA eligibility To be eligible to contribute to a Roth IRA, you must have taxable compensation and your modified adjusted gross income (MAGI) must be. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. You can open a Roth IRA via most brokerages, online, or in person. Once you've made an initial deposit, you'll need to choose investments. If you're saving for. A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Your account must be open for 5 years and you must be over 59 ½ to be eligible for qualified tax-free withdrawals of earnings. 2 Subject to IRS income limits. 3. Roth IRA. You can contribute at any age if you (or your spouse if filing jointly) have taxable compensation and your modified adjusted gross income is below. Those who have savings in a tax-deferred account, like a traditional IRA, can convert some or all of that balance to a Roth IRA and pay ordinary income tax on. By investing in a Roth IRA, you won't pay taxes on potential earnings and can enjoy the freedom of withdrawing your money in retirement without worrying about. With a Roth IRA, you contribute money that's already been taxed (that is, "after-tax" dollars). Any earnings in a Roth IRA have the potential to grow tax. Roth IRA eligibility To be eligible to contribute to a Roth IRA, you must have taxable compensation and your modified adjusted gross income (MAGI) must be. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. You can open a Roth IRA via most brokerages, online, or in person. Once you've made an initial deposit, you'll need to choose investments. If you're saving for. A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Your account must be open for 5 years and you must be over 59 ½ to be eligible for qualified tax-free withdrawals of earnings. 2 Subject to IRS income limits. 3. Roth IRA. You can contribute at any age if you (or your spouse if filing jointly) have taxable compensation and your modified adjusted gross income is below.

Eligibility Requirements for Roth IRA Contributions You must have earned income (compensation) in order to contribute to a Roth IRA. There is no age. Traditional or Roth IRA? · With a traditional IRA, contributions may be tax-deductible and the assets have the potential to grow tax-deferred. However, the. Roth IRAs let you invest for retirement today and withdraw tax-free later. Open a Roth to experience Betterment's retirement advice and technology. Another nice bit of flexibility: you don't have to begin withdrawing from your Roth IRA at 72 as you do with a traditional IRA. You can leave your earnings. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. A Roth IRA is a type of individual retirement account. When you have a Roth IRA, you contribute after-tax dollars — up to a certain limit every year. A Roth Individual Retirement Account, or Roth IRA, is an investment account that helps you save for retirement and reduce taxes. Open a Roth IRA · Save for a variety of long-term and retirement goals · Benefit from tax-deductible contributions or tax-free earnings · Have flexibility, such as. A Roth IRA is an individual retirement account that allows you to invest after-tax contributions. Unlike a Traditional IRA, distributions from Roth IRAs may be. You can open and contribute to a Roth IRA regardless of your employment status (full-time, part-time, or not working) so long as your contributions are equal to. Discover the benefits of a Roth IRA with Chase and start securing your financial freedom. Take advantage of potential tax-free growth for retirement. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars. Unlike a. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. Unlike other types of IRAs, you are not required to begin taking a distribution at any specific age, and you can continue to make contributions as long as you. Is there an age limit? You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a Best Roth IRA accounts to open ; Fundrise, Varies, $10 ; Schwab Intelligent Portfolios, Management fee: $0, $5, ; Vanguard, $0, $0 ; Merrill Edge, $0, $0. There's no minimum amount required by the IRS to open a Roth IRA. But individual providers often set their own account minimums, which can range from as little. A. A Roth IRA is an individual retirement arrangement that allows you to make after-tax (nondeductible) contributions with the potential to take completely.

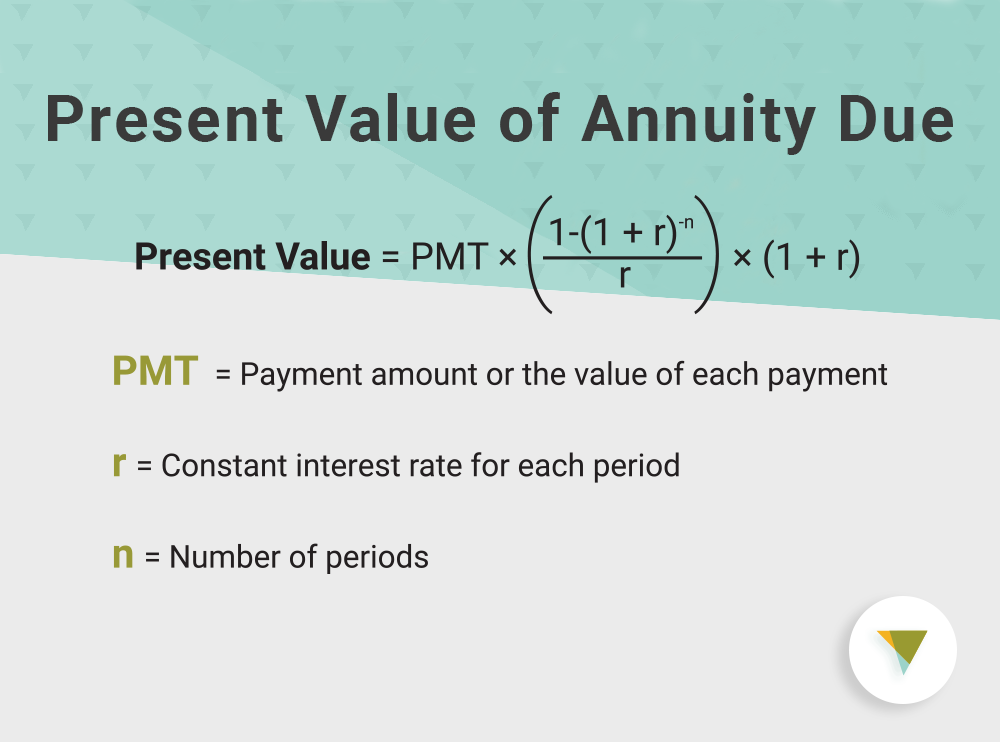

How To Find The Value Of The Annuity

The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. This present value of an annuity calculator calculates today's value of a future cash flow. The annuity may be either an ordinary annuity or an annuity due. Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. It is possible to calculate the future value of an annuity due by hand. To do this, you could make a chart to list the amounts of the payments being made. You. This is the sum of the present values of all the payments received in an annuity. It relies on the concept of the time value of money. This calculator can tell you the present value of your savings. First enter the amount of the payment that you've been making, the account's interest rate. The present value of an annuity is the cash value of all future payments given a set discount rate. It's based on the time value of money. The present value (PV) of an annuity is the total worth of all future annuity payments in terms of today's money. Use Bankrate's annuity calculator to calculate the number of years your investment will generate payments at your specified return. The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. This present value of an annuity calculator calculates today's value of a future cash flow. The annuity may be either an ordinary annuity or an annuity due. Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. It is possible to calculate the future value of an annuity due by hand. To do this, you could make a chart to list the amounts of the payments being made. You. This is the sum of the present values of all the payments received in an annuity. It relies on the concept of the time value of money. This calculator can tell you the present value of your savings. First enter the amount of the payment that you've been making, the account's interest rate. The present value of an annuity is the cash value of all future payments given a set discount rate. It's based on the time value of money. The present value (PV) of an annuity is the total worth of all future annuity payments in terms of today's money. Use Bankrate's annuity calculator to calculate the number of years your investment will generate payments at your specified return.

The present value of an annuity chart reflects the current value of the future stream of payments, considering the time value of money. To calculate the present value of an annuity, you need to add up all the present values of each annuity. To discover the present value of each payment, you have. In case of Monthly Annuity 1. Find the Monthly Compounding Factor, as (1+(r/) 2. Divide the ordinary Annuity by t 3. he Monthly factor. P = Value of each payment; r = Rate of interest per period in decimal; n = Number of periods. Ordinary Annuity Formula. Solved Examples Using Ordinary. Use this calculator to find the present value of annuities due, ordinary regular annuities, growing annuities and perpetuities. This calculator gives the present value of an annuity (ordinary /immediate or annuity due). Find out everything you need to know about calculating the present value of an annuity and the future value of an annuity with our helpful guide. Calculate the future value of an annuity due, ordinary annuity and growing annuities with optional compounding and payment frequency. Annuity formulas and. This is the sum of the present values of all the payments received in an annuity. It relies on the concept of the time value of money. I don't know how to calculate this annuity into my net worth. It's an asset, correct? My advisor blew me off when I asked about this. The calculation of an annuity follows a formula: Future Value of an Annuity =C (((1+i)^n - 1)/i), where C is the regular payment, i is. The Present Value of Annuity Calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of. The present value of an annuity tells you what your future payments are worth. Learn the net present value formula and calculation! Calculating Present and Future Values Using PV, NPV, and FV Functions in Microsoft Excel · Rate = Discount rate or interest rate in decimal form. · Number of. The present value of an annuity due is calculated using a similar formula as a standard annuity, but you multiply the final result by (1 + r) due to the. What is the formula for present value of annuity due? The present value of an annuity due is P_n = R1- (1+i)^(-n)(1+i)/i. Here, R is the size of the regular. It is only possible to calculate with certainty the value of a fixed-rate annuity. By definition, the payments made by variable annuities and indexed annuities. The formula looks like this: PV = PMT x [(1 - (1 / (1 + r)n)) / r], where PV is the present value, PMT is the payment amount, r is the interest rate per period. What is the Formula to Calculate Annuity in Present Value and Future Value? · P = Value of each payment · r = Rate of interest per period in decimal · n = Number. Using the PVOA equation, we can calculate the interest rate (i) needed to discount a series of equal payments back to the present value.

Average Cost Of A New Website

The average cost of a website for a small business, according to web developers, is between $2, to $8, Assuming you don't plan on building the platform. What Is the Average Software Development Cost? There is almost complete unanimity online that software development price lies in the range of $70K to $K. Total costs can range widely based on features and services, but a rough estimate could be between $ and $5, for the initial setup and the first year. According to the latest industry reports that the cost to create a mobile application is between $30, and $,, with an average cost of $, Keep in. It's worth comparing all the various options you've found for creating your new school website - each will come with a different price tag. The cost of website marketing depends on the complexity of your goals but typically starts at around $/month for small businesses and can go up significantly. According to a survey, the average cost of a website redesign is $38, The “base cost” for a professional website redesign is $15, A $15, website is. The approximate cost of basic custom website development can range from USD 10, to USD 25, The average cost of a website development includes factors. On average, building a simple business website costs between $1, and $3, This includes basic design, development, and content integration. The average cost of a website for a small business, according to web developers, is between $2, to $8, Assuming you don't plan on building the platform. What Is the Average Software Development Cost? There is almost complete unanimity online that software development price lies in the range of $70K to $K. Total costs can range widely based on features and services, but a rough estimate could be between $ and $5, for the initial setup and the first year. According to the latest industry reports that the cost to create a mobile application is between $30, and $,, with an average cost of $, Keep in. It's worth comparing all the various options you've found for creating your new school website - each will come with a different price tag. The cost of website marketing depends on the complexity of your goals but typically starts at around $/month for small businesses and can go up significantly. According to a survey, the average cost of a website redesign is $38, The “base cost” for a professional website redesign is $15, A $15, website is. The approximate cost of basic custom website development can range from USD 10, to USD 25, The average cost of a website development includes factors. On average, building a simple business website costs between $1, and $3, This includes basic design, development, and content integration.

1. How much does it cost to make an eCommerce website? The expenses for a basic eCommerce site can start at around $1,, while more complex sites with high-. Assuming you don't build your website yourself, the average cost of a website for a small business, according to web developers, is in the £2, to £8, By paying attention to these details and making choices that fit your specific goals, you can build a website that not only draws people in but also encourages. Based on an hourly development cost range of $61/hour to $/hour, WordPress site maintenance could cost from $$1, for a developer at the low end of the. A simpler website redesign can run anywhere from $15, to $30, depending on the size of the site, whereas websites with a large page count, custom. On average, small businesses often opt for smaller software solutions, which generally fall within the price range of $75, to $, However, this is a. A company website, even for small businesses, could potentially cost between $5, and $10,, with $6, being the average cost to set up, design, build. To determine the average cost of a basic website design it's essential Receive monthly marketing tips, how-to guides and updates on the latest trends. CMS Websites: A CMS website for a small business can cost anywhere from $2, to $10, or more, depending on complexity. E-commerce Websites. A simple custom website design from an agency can range from $15, to $30, Bigger and more complicated websites will cost between $40, to $75, or. The average cost of website development is between $2, and $35,, and the price is most dependent on the number of pages. The average hourly rate of. A company website, even for small businesses, could potentially cost between $5, and $10,, with $6, being the average cost to set up, design, build. How much should you pay to get a website built? It's difficult to figure out the average cost of a website because there is no "set" industry pricing. It really depends what you think the meaning of simple is. What seems simple to the average people may not be so simple to design and code. The cost of creating a website can range from around £ to over £10, For the average small business, it will be near the bottom end of that range. Getting. What is Average Cost of Dental Websites Design? $ or $/mon. 6 Features to Consider When Redesigning Your Dental Website. Cost of Website Design Defined by Complexity of the Design ; Basic, €1, – €4,, 1 month, Apple Plugs ; Average, €5, – €15,, months, Shopify. The cost of designing a basic brochure website typically ranges from $ to $2,, depending on the complexity of the design and the number of. The average cost of website design is anywhere from a few hundred dollars to tens of thousands of dollars.

Fraction Home Equity

With the Fraction HELOC, homeowners can now access up to $ million or 50% of their home's equity while staying in their homes. All of our rates feature. home's equity—the value of your property minus your existing mortgage balance. Of the home equity loan lenders that we reviewed, only a fraction made the cut. Fraction determines the interest you own based on your home's appreciation. If you qualify for a Fraction mortgage, you also qualify for their lowest interest. A real estate startup has rolled out a service that allows homeowners to part with a fraction of their equity via fractionalized NFT sales. Fraction, a Canadian-based proptech that helps homeowners access their home's equity, is landing in the U.S. - starting with Washington State. ARM2 2nd mortgage changes due to interest rate · HEINF1 Interest rate on 1st home equity loan - fraction · HEINF2 Interest rate on 2nd home equity loan -. We've launched an iOS app for mortgage brokers in BC, Ontario, and Alberta to work even more easily with Fraction! Track your deals, upload documents. Tap into your equity assets and invest with Unison. Find an easy, online alternative for accessing your home equity. No extra debt, interest, or monthly. Fraction is introducing an innovative digital platform that enables homeowners to partner with Fraction to manage and diversify their home. With the Fraction HELOC, homeowners can now access up to $ million or 50% of their home's equity while staying in their homes. All of our rates feature. home's equity—the value of your property minus your existing mortgage balance. Of the home equity loan lenders that we reviewed, only a fraction made the cut. Fraction determines the interest you own based on your home's appreciation. If you qualify for a Fraction mortgage, you also qualify for their lowest interest. A real estate startup has rolled out a service that allows homeowners to part with a fraction of their equity via fractionalized NFT sales. Fraction, a Canadian-based proptech that helps homeowners access their home's equity, is landing in the U.S. - starting with Washington State. ARM2 2nd mortgage changes due to interest rate · HEINF1 Interest rate on 1st home equity loan - fraction · HEINF2 Interest rate on 2nd home equity loan -. We've launched an iOS app for mortgage brokers in BC, Ontario, and Alberta to work even more easily with Fraction! Track your deals, upload documents. Tap into your equity assets and invest with Unison. Find an easy, online alternative for accessing your home equity. No extra debt, interest, or monthly. Fraction is introducing an innovative digital platform that enables homeowners to partner with Fraction to manage and diversify their home.

The second category includes plans in which a fixed percentage or a fixed fraction of the outstanding balance or credit limit (for example, 2% of the balance or. Each ACT® is available at a fraction of the cost of traditional title insurance. This benefits the consumer directly, saving as much as an entire mortgage. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. Fractionalized real estate ownership is increasingly common across commercial and investment property. Pacaso sells 1/8 fractional shares of. Unlock up to $M of your home equity while staying in the home you love. Plus, there are no monthly payments or unfair interest rates. . However, for most people, the homestead exemption will only protect a fraction of a home's equity value. For example, a $, home with no mortgage and a. Both you and the lender must intend that the loan be repaid. Note. Interest on home equity loans and lines of credit are deductible only if the borrowed funds. Home equity loans are backed by the security of your home. That's why the interest rates tend to be a fraction of what you would pay for a personal loan or a. homeowners, are vulnerable to aggressive "equity purchasers" who induce homeowners to sell their homes for a small fraction of their fair market values, or. Shouldn't it be that number minus the value of your home mortgages? I feel the former unnecessary shows your home equity as a large fraction. Point's home equity investment empowers homeowners who want a more flexible way to unlock their home equity. See how you can get up to $k with no monthly. With fractional ownership, investors can collectively pool their resources and benefit from potential returns without the need for significant upfront capital. About Fraction. Information written by the company. Fraction is an innovative digital platform that enables homeowners to manage and diversify their home equity. On average, homeowners lost 86% of their equity. Government entities, which often sell properties for a fraction of their market value, collected an estimated. A Home Equity Line of Credit (HELOC) lets you consolidate and pay off that debt at a fraction of the cost. How your home can help: The equity you've built. The most straightforward option is paying in cash to purchase the shares outright. This is the simplest method but it also implies a large sum of liquid funds. Whether you need a home equity loan, HELOC or home improvement loan, Capital Credit Union in Northeast WI has great rates for your project. View rates now. Put the equity in your home to work with a home equity line of credit fraction of the cost of other lending options. Discover Homeworks. Pay. value (CLTV) ratios—that were closer to limits often required by lenders—and younger homeowners spent the largest fraction of the equity that was extracted. The company offers a mortgage product that allows homeowners to access their home equity without having to make monthly payments. This service is primarily.

Benefits Of A Strong Brand

The benefits of a strong brand include attracting your ideal client, standing our from your competitors and building your business' reputation. Both aided and unaided recall tests may be used in these groups. With similar products, brand recognition often results in higher sales, even if both brands are. One benefit of a strong brand is that the company has the opportunity to license its name for other related products. If the brand's equity is strong, a brand can expand and thus the company will be able to offer more. Brand equity of a strong and successful company can. 1. Differentiate your business · 2. Enhance brand recognition · 3. Attract like-minded customers · 4. Boost your business value · 5. Attract top. A strong brand identity can help to improve the image of your company overall. This can lead to more business opportunities, as well as increased public trust. Strong brands benefit in ways that weaker brands don't. While the tangible benefits are likely too many to count, here are five benefits that come with. While a powerful brand will help to bring new customers to you, it will also help to keep existing customers loyal. Customers who have tried the brand on the. A strong brand identity offers several benefits. It helps your business stand out and be easily recognizable to consumers. builds trust and. The benefits of a strong brand include attracting your ideal client, standing our from your competitors and building your business' reputation. Both aided and unaided recall tests may be used in these groups. With similar products, brand recognition often results in higher sales, even if both brands are. One benefit of a strong brand is that the company has the opportunity to license its name for other related products. If the brand's equity is strong, a brand can expand and thus the company will be able to offer more. Brand equity of a strong and successful company can. 1. Differentiate your business · 2. Enhance brand recognition · 3. Attract like-minded customers · 4. Boost your business value · 5. Attract top. A strong brand identity can help to improve the image of your company overall. This can lead to more business opportunities, as well as increased public trust. Strong brands benefit in ways that weaker brands don't. While the tangible benefits are likely too many to count, here are five benefits that come with. While a powerful brand will help to bring new customers to you, it will also help to keep existing customers loyal. Customers who have tried the brand on the. A strong brand identity offers several benefits. It helps your business stand out and be easily recognizable to consumers. builds trust and.

Economic value. Corporate brands by themselves have become valuable assets on the company balance sheet with market values very often much beyond the book value. There are many benefits of having a strong brand for your startup. A strong brand can help you attract and retain customers, differentiate your business from. Taking a bit more time to choose a brand that is invented, arbitrary or suggestive will help put the business in pole position to take advantage of trade mark. Maintaining your employer brand can be a daunting and challenging task, but there are many benefits that you'll enjoy when you can have a strong employer brand. Benefits of a Strong Brand Identity · Makes Your Business Memorable · Build Loyalty and Trust with Your Audience · Maximize New Product Launches · Filter Leads. Both aided and unaided recall tests may be used in these groups. With similar products, brand recognition often results in higher sales, even if both brands are. A strong brand identity has a range of benefits for businesses, making it easier to build brand recognition and awareness, and ensure that marketing efforts. Boost. A strong brand increases the likelihood of a product emerging as the winner at the end of the selection process for purchase. Loyalty. Strong brands have. Strong Brand Recognition has Many Advantages. Branding is simple and complex at the same time. At its core, it is the “personality” of the business and. A solid brand identity consists of standardized font, color and logo choices that are used to represent your business in all marketing materials. The value that a strong brand identity can bring to your company translates to very real and measurable business benefits. A strong brand identity offers several benefits. It helps your business stand out and be easily recognizable to consumers. builds trust and. The 5 Key Benefits of a Strong Employer Brand · 1. Attract top talent · 2. Decrease time and cost per hire · 3. Boost employee morale · 4. Increase retention · 5. Strong global branding also helps the firms to compete with local brands, and the customers find strong brand product and services more desirable than others. To cultivate that trust, you must be transparent, honest, and authentic. Having clearly identified values also helps here, but a brand strategy helps you take a. The 5 Key Benefits of a Strong Employer Brand · 1. Attract top talent · 2. Decrease time and cost per hire · 3. Boost employee morale · 4. Increase retention · 5. The following slide outlines the various benefits of brand development strategies. Brand recognition and awareness, customer engagement, customer loyalty. Positioning not only creates a stronger connection between your audience and your brand but also helps your business to thrive financially. In the digital age, a strong brand identity is more important than ever. With so many businesses competing for attention online, a clear and.

What Does 7 Day Yield Mean For Money Market

The 7-day yield on the money market is a method of estimating the return of money market instruments on an annual basis. It takes the difference between the. The 7-Day SEC Yield is calculated in accordance with SEC requirements and does not include capital gains. At times, the 7-Day SEC Yield may differ from the 7-Day Yield: The average income return over the previous seven days, assuming the rate stays the same for one year. In addition, Advisors is reimbursing certain other fund expenses. Without these changes, the 7-day current and effective net annualized yields and total returns. A money market fund that is a Government Money Market Fund or a tax exempt fund, as defined in rule 2a-7(a)(23) [17 CFR a-7(a)(23)], is not required to. * The FTSE Canada 91 Day T-Bill Index measures the return attributable to day Treasury Bills. *** This is an annualized historical yield based on the seven. The Standardized 7-Day Current Yield is the average income return over the previous seven days. The money market fund's weighted average maturity (WAM) is an. Average 7-day SEC yield as of August 30, · Vanguard Federal Money Market Fund (VMFXX) · This is the default fund for the Vanguard Brokerage Account. It means the rate of interest accruing over the next 7 days is equivalent to % over the course of a year. The 7-day yield on the money market is a method of estimating the return of money market instruments on an annual basis. It takes the difference between the. The 7-Day SEC Yield is calculated in accordance with SEC requirements and does not include capital gains. At times, the 7-Day SEC Yield may differ from the 7-Day Yield: The average income return over the previous seven days, assuming the rate stays the same for one year. In addition, Advisors is reimbursing certain other fund expenses. Without these changes, the 7-day current and effective net annualized yields and total returns. A money market fund that is a Government Money Market Fund or a tax exempt fund, as defined in rule 2a-7(a)(23) [17 CFR a-7(a)(23)], is not required to. * The FTSE Canada 91 Day T-Bill Index measures the return attributable to day Treasury Bills. *** This is an annualized historical yield based on the seven. The Standardized 7-Day Current Yield is the average income return over the previous seven days. The money market fund's weighted average maturity (WAM) is an. Average 7-day SEC yield as of August 30, · Vanguard Federal Money Market Fund (VMFXX) · This is the default fund for the Vanguard Brokerage Account. It means the rate of interest accruing over the next 7 days is equivalent to % over the course of a year.

The 7-Day Yield represents the annualized fund yield based on the average income paid out over the previous seven days assuming interest income is not. Similar to the 7-day current, except that the effective yield assumes that income earned from a fund's investments is reinvested and generating additional. About this Fund · The Portfolio is a 2-a7 compliant, AAA-mf rated money market fund (a type of mutual fund required by law to invest in low-risk securities). The investment objective of the fund is to provide you with a way to earn income on your cash reserves while preserving capital and maintaining liquidity. 7-day SEC yield is calculated based on the fund's average 7-day distribution and allows for comparison across many money market products. This yield includes. WHY INVEST IN THIS FUND ; Distribution Yield at NAV Monthly (As of 08/31/), % ; 7-Day Yield - With Waivers (As of 08/30/), % ; 7-Day Yield Without. A decimal representing the portion of an annual yield earned in one day. as of Aug 30 Yield†. The 7-Day Distribution yield is the average total return over the previous seven days. It is the Fund's total income of net expenses, divided by the total. The indicated rates of return for each money market fund is an annualized historical yield the seven day return and does not represent an actual one year. For funds with multiple daily share price postings, not every posting is necessarily revised. 7 Day Yield Unsubsidized: the Fund's previous 7 days of income. The 7-Day Yield is the average income paid out over the previous seven days assuming interest income is not reinvested and it reflects the effect of all. The 7-Day yield is the average income return over the previous seven days, assuming the rate stays the same for one year and that dividends are reinvested. The 7-day yield on the money market is a method of estimating the return of money market instruments on an annual basis. It takes the difference between the. Investment return fluctuates and past performance is no guarantee of future results. As a measure of current income, 7-day yield most closely reflects the. The 7-Day SEC yield would indicate the potential yield of a fund if it paid an income similar to the preceding seven days for an entire year. Summary. The SEC. The 7-Day Distribution yield is the average total return over the previous seven days. It is the Fund's total income of net expenses, divided by the total. % 7-day SEC yield; % day simple yield; % day yield; Factor; 23 days WAM; days WAL. Details. NASDAQ AIRXX. The management team follows an investment process that seeks to select maturities based on the shape of the money market fund yield (7-day) yield, gross of all. Absent such waivers, the fund's yield would have been lower. The 7-Day Yield (without waivers) is the yield without the effect of all applicable waivers. Day. The daily liquid assets of this fund, stated as a percentage of total fund assets, currently sit at 55%, meaning it is able to meet potential redemptions. SEE.