profhimservice53.ru Prices

Prices

Nigeria Crypto Currency

Recent survey ranks Nigeria amongst the top ten countries in the world with the highest number of Cryptocurrency transactions. Our Freeman Law Cryptocurrency Law Resource page provides a summary of the legal status of cryptocurrency for each country across the globe. The Central Bank of Nigeria (CBN) has lifted its ban on digital currency transactions. In February the CBN had barred financial institutions from crypto. Cryptocurrency is capable of providing significant benefits as it should be considered as a medium to support the growth process in Nigeria by increasing. Is cryptocurrency legal in Nigeria? Cryptocurrencies are not recognized by the Central bank of Nigeria (CBN) as legal tender. In February , the CBN banned. In this special report, CoinMarketCap Academy venture to Nigeria — finding out how the high crypto adoption rate, 11th globally, came about and the. The government of Nigeria has blocked access to cryptocurrency exchanges operating in the country in an attempt to stem the devaluation of the naira. 2. Kraken: Safest Crypto Exchange in Nigeria. Screenshot by Author. As a centralized exchange based out of San Francisco, Kraken is one. NairaEx is a leading Nigerian Bitcoin exchange where you can buy and sell Bitcoin, Litecoin, Bitcoin Cash, Ethereum and Perfect Money with Naira at best. Recent survey ranks Nigeria amongst the top ten countries in the world with the highest number of Cryptocurrency transactions. Our Freeman Law Cryptocurrency Law Resource page provides a summary of the legal status of cryptocurrency for each country across the globe. The Central Bank of Nigeria (CBN) has lifted its ban on digital currency transactions. In February the CBN had barred financial institutions from crypto. Cryptocurrency is capable of providing significant benefits as it should be considered as a medium to support the growth process in Nigeria by increasing. Is cryptocurrency legal in Nigeria? Cryptocurrencies are not recognized by the Central bank of Nigeria (CBN) as legal tender. In February , the CBN banned. In this special report, CoinMarketCap Academy venture to Nigeria — finding out how the high crypto adoption rate, 11th globally, came about and the. The government of Nigeria has blocked access to cryptocurrency exchanges operating in the country in an attempt to stem the devaluation of the naira. 2. Kraken: Safest Crypto Exchange in Nigeria. Screenshot by Author. As a centralized exchange based out of San Francisco, Kraken is one. NairaEx is a leading Nigerian Bitcoin exchange where you can buy and sell Bitcoin, Litecoin, Bitcoin Cash, Ethereum and Perfect Money with Naira at best.

In this paper, we discuss the impact of cryptocurrency on some selected sectors of the Nigerian economy. Yellow Card allows you to trade bitcoin, USDT, and other cryptocurrencies at the best rates. The platform offers a zero fee for your transactions. bitcoin wallet - buy sell cryptocurrency with Busha Nigeria. Join one of Experience the most convenient platform for trading your Bitcoin and other crypto. Superprof is the best place to find an expert to help you learn how to buy and sell bitcoin, ethereum, or any other currencies to make a profit. This article outlines the framework governing digital assets and cryptocurrency regulations in Nigeria. This article outlines the framework governing digital assets and cryptocurrency regulations in Nigeria. The committee also urged the government of Bola Tinubu to develop the capital and crypto markets in order to defend the local currency. Cryptocurrency Prices in Nigerian Naira (NGN). The imminent regulation of the Crypto Assets Market is something that must be done by SEC as the primary regulator for securities and investments in Nigeria as. 1. Crypto Investment: Investing in cryptocurrency is one of the best ways to make great money from crypto without stress. Cryptocurrencies - Nigeria · Revenue in the Cryptocurrencies market is projected to reach US$m in · Revenue is expected to show an annual growth rate . There are already thousands of digital currencies, commonly called cryptocurrencies. Bitcoin is the most well-known fully decentralized cryptocurrency. Another. Binance Nigeria. In just four years of existence (May ), Binance has established itself as the leading exchange in the crypto market. Binance initially. The purpose of this study was to find out the opinions of Nigerians and crypto currency traders on the effects and implications of crypto currency ban in. Top 5 Popular Cryptocurrencies in Nigeria · 1. Bitcoin (BTC) – The Pioneer and Unrivaled Leader · 2. Ethereum (ETH) – Beyond Digital Currency · 3. Binance Coin . We're the first crypto exchange to receive a provisional Digital Assets Exchange license by Nigeria's SEC. Get familiar with our products. A complete suite of. The top 5 African countries whose communities are adopting Bitcoin are South Africa, Nigeria, Zimbabwe, Kenya, and Ghana. The imminent regulation of the Crypto Assets Market is something that must be done by SEC as the primary regulator for securities and investments in Nigeria as. A Nigeria cryptocurrency license provides clear regulatory guidelines, enhancing industry transparency. These regulations protect investors from scams and. Lopeer is the best cryptocurrency exchange to buy and sell bitcoin, Tether USD, and other cryptos in Nigeria Buy and sell crypto with different deposit and.

How Much State Sales Tax Can I Deduct

There is a limit of $10, ($5, if MFS) on the amount of sales tax you can claim in to The $10, limit applies to the total amount a taxpayer. These are only a few examples; all tangible personal property purchased out of state is subject to the Use Tax. How and when do I report and pay Use Tax? Save sales receipts and deduct actual sales taxes paid. · Use the IRS's sales tax tables to figure the deduction. The tables are on the Form instructions. state will tax the income as income of the trust settlor. Because the trust In such cases, an entity may account for the taxes paid to the other state and. sales into the state to register and collect Kentucky sales and use tax. The should begin a good faith effort to come into compliance with these. Every state that has a sales tax also has a use tax on the purchase of goods and services as defined by law. State sales taxes apply to purchases made in. Starting in tax year , taxpayers cannot deduct more than $10, of total state and local taxes. That provision of the law is scheduled to expire after You can't deduct both: You must choose between income tax and sales tax. As a general rule, you should deduct whichever is more. However, because of the annual. The Tax Cuts and Jobs Act (TCJA) capped it at $10, per year, consisting of property taxes plus state income or sales taxes, but not both. How Does the SALT. There is a limit of $10, ($5, if MFS) on the amount of sales tax you can claim in to The $10, limit applies to the total amount a taxpayer. These are only a few examples; all tangible personal property purchased out of state is subject to the Use Tax. How and when do I report and pay Use Tax? Save sales receipts and deduct actual sales taxes paid. · Use the IRS's sales tax tables to figure the deduction. The tables are on the Form instructions. state will tax the income as income of the trust settlor. Because the trust In such cases, an entity may account for the taxes paid to the other state and. sales into the state to register and collect Kentucky sales and use tax. The should begin a good faith effort to come into compliance with these. Every state that has a sales tax also has a use tax on the purchase of goods and services as defined by law. State sales taxes apply to purchases made in. Starting in tax year , taxpayers cannot deduct more than $10, of total state and local taxes. That provision of the law is scheduled to expire after You can't deduct both: You must choose between income tax and sales tax. As a general rule, you should deduct whichever is more. However, because of the annual. The Tax Cuts and Jobs Act (TCJA) capped it at $10, per year, consisting of property taxes plus state income or sales taxes, but not both. How Does the SALT.

sales taxes claimed in lieu of state and local income taxes). Thus, an individual can deduct $10, in real property tax paid for state tax purposes. The percent state sales and use tax is distributed into four funds to finance portions of state government – General Revenue ( percent), Conservation . Does Alabama provide for a federal income tax deduction? Yes. Federal income State, county and city sales and use taxes paid on tangible personal. If I have several locations in the state, do I need a separate sales tax number for each location? How much sales tax do I pay when I buy a vehicle? The sales. Thus, only the amount of tax that is equal to the general sales tax rate will be allowed as a deduction. A motor vehicle for this purpose include automobiles. You can deduct up to $10, of the state and local taxes you paid during each year. You can only deduct state and local income taxes or state and local sales. If you paid another state's sales or use tax For example, if the returned merchandise had been sold for $15 plus sales tax, you would claim only $15 as a. The IRS allows for a deduction of sales and use tax paid as an option for those who itemize their deductions, letting them choose between deductions for. How much rent can I take off? You can deduct up to $3, or the amount of Regardless, he is still eligible to claim the deduction on his state tax return. Sales to out-of-state buyers (Nonresidents may not claim the out-of-state out-of-state retailer*** who does not collect Illinois sales tax, the. Taxpayers who keep all their receipts can deduct actual sales tax and use tax paid. tax to claim, or taxpayers can use the Optional State Sales Tax Tables. You can't deduct both: You must choose between income tax and sales tax. As a general rule, you should deduct whichever is more. However, because of the annual. Your deduction for state and local income, sales, and property taxes is limited to a combined total deduction. The limit is $10, - $5, if married filing. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6%. Iowa law imposes both a sales tax and a use tax. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax, as many. You can choose to deduct either sales taxes paid during or state income taxes you withheld from your W-2 a. No. Local option tax only applies to sales tax. When you pay use tax, only pay the 6% use tax rate. Do not add the 1%. However, for , your deduction for state and local income taxes, sales taxes, and property taxes is limited to a combined total of $10, ($5, if Married. The IRS allows for a deduction of sales and use tax paid as an option for those who itemize their deductions, letting them choose between deductions for. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum.

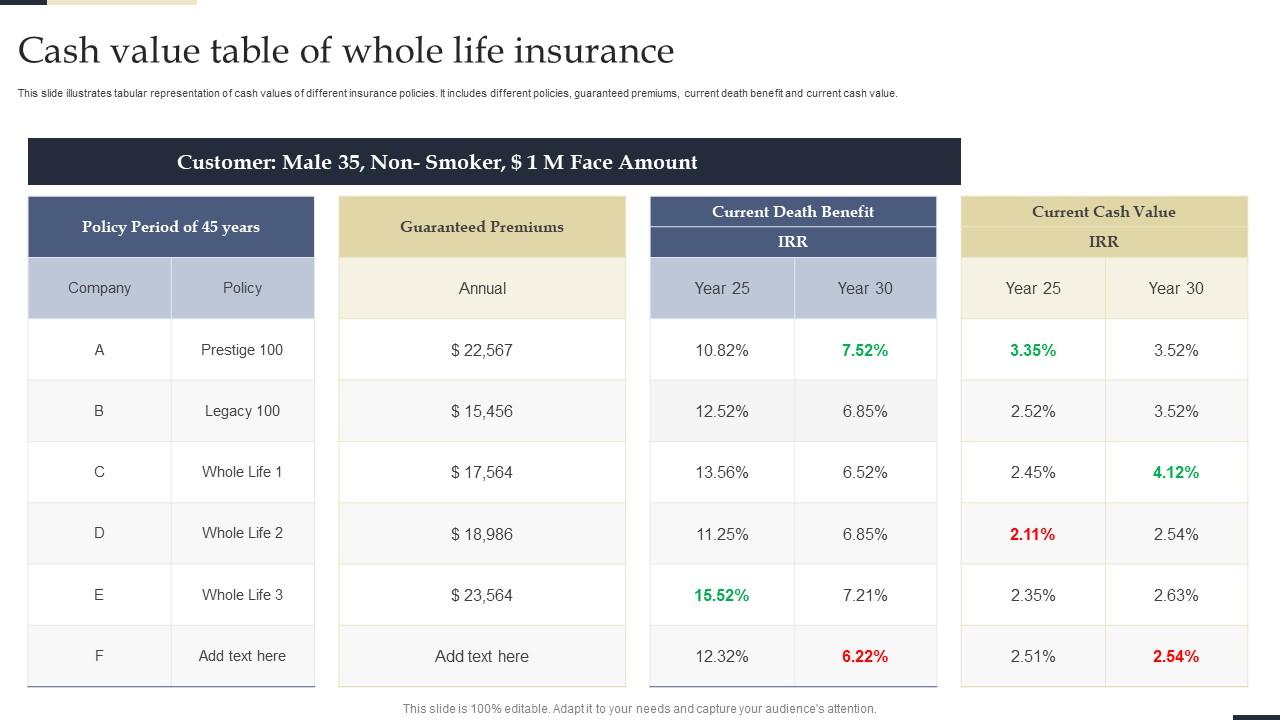

Whole Life Policy Cash Value

Whole life. Whole life insurance is also referred to as “ordinary life” or “straight life.” It provides coverage for your entire lifetime. · Universal life. You can usually see the cash value of your life insurance policy, together with your surrender cash value, on your statement. The two might be different if the. Life insurance with cash value is a type of permanent policy that can build funds over time through the cash value component. Some types of permanent life insurance policies, such as whole life or universal life, have a cash value feature in addition to the death benefit. Part of your. Its cash value is the stated face value of the policy. The amount you can access without paying taxes is the face value minus your basis and any withdrawals you. A portion of every premium payment you make goes towards your policy's cash value, which grows at a fixed rate over time. When the cash value grows to a certain. A cash value life insurance policy offers a death benefit plus a cash component that builds in value. Find out how it can be a life-long asset. All loans must be repaid before you pass or they will be deducted from the policy's death benefit. How Does the Cash Value Benefit Work? Whole life policies are. With cash value life insurance, a portion of every premium payment goes toward a savings feature that collects interest over time. Whole life. Whole life insurance is also referred to as “ordinary life” or “straight life.” It provides coverage for your entire lifetime. · Universal life. You can usually see the cash value of your life insurance policy, together with your surrender cash value, on your statement. The two might be different if the. Life insurance with cash value is a type of permanent policy that can build funds over time through the cash value component. Some types of permanent life insurance policies, such as whole life or universal life, have a cash value feature in addition to the death benefit. Part of your. Its cash value is the stated face value of the policy. The amount you can access without paying taxes is the face value minus your basis and any withdrawals you. A portion of every premium payment you make goes towards your policy's cash value, which grows at a fixed rate over time. When the cash value grows to a certain. A cash value life insurance policy offers a death benefit plus a cash component that builds in value. Find out how it can be a life-long asset. All loans must be repaid before you pass or they will be deducted from the policy's death benefit. How Does the Cash Value Benefit Work? Whole life policies are. With cash value life insurance, a portion of every premium payment goes toward a savings feature that collects interest over time.

With cash value life insurance, a portion of every premium payment goes toward a savings feature that collects interest over time. A whole life insurance policy can also build cash value. You may be able to withdraw or borrow against this cash value if needed. A whole life policy can be. Part of your premium is used to build cash value with a guaranteed minimum interest rate. You can choose to let it grow or use it if you need it. Flexible. The amount of cash value available will generally depend on the type of permanent policy purchased, the amount of coverage purchased, the length of time the. The cash value of a whole life policy typically earns a fixed rate of interest. Withdrawals and outstanding loan balances reduce death benefits. Cash value builds at a guaranteed rate with each month's premium. Can be used during your lifetime. If you outlive your policy at age , you receive the cash. And if you withdraw more money than you paid in premiums, you'll probably have to pay taxes on it. If you withdraw the entire cash value, the company might. With a cash value policy, your premiums are typically set at a fixed rate. A portion of your premium goes to fund the death benefit, while another portion goes. How Cash Value Life Insurance Works The cash value of life insurance earns interest, and taxes are deferred on the accumulated earnings. While premiums are. Talk with your insurance professional or one of our life insurance specialists today at , or schedule a consultation for a no-obligation quote. Cash value life insurance is a type of permanent life insurance that can earn interest, help pay premium costs or allow tax-free withdrawals. There are two main types of permanent life coverage with cash value: whole life and universal life insurance. Whole life premiums are fixed for life – they. Typically provides no cash value, but may offer lower premiums initially, especially at younger ages. Generally will. Why VALife may be important for you. Building cash value: whole life insurance policies include a tax-deferred savings account (the cash value component) which has hands-off, guaranteed growth. Permanent life insurance is our signature product. It can provide money to your family when you die, and can build cash value while you live. If your need for the death benefit changes, you can withdraw some of this cash value without needing to cancel the policy. (This option would reduce the amount. Whole life insurance offers lifetime protection that builds cash value at a guaranteed interest rate. Permanent life insurance can help cover long-term. Cash value is a feature found in permanent life insurance policies. Your insurer splits your premium payments: some go toward the policy's death benefit, but. A cash value life insurance policy offers a death benefit plus a cash component that builds in value. Find out how it can be a life-long asset. Cash value is the portion of a permanent life insurance policy that earns interest and can be accessed during your lifetime to fund retirement, cover premiums.

Hamilton Tickets Price Range

Select your event date and price range to find the best tickets from Front Row Seats at the best prices. Price Range: The Box Office is closed for in-person ticket sales and on concert day/night. Keep up to date. Join the HPO mailing list. Connect with us. Hamilton on Broadway · See it This Week · Last-minute tickets are available for all performances $$ (inclusive of handling fees). You can buy Hamilton front row tickets to their concert for between $ and $ They typically range between $$ each if they are offered. Find out more about the events at Saenger Theatre and buy tickets directly from the official box office. Get the best deals on plays, musicals and shows. Buy Hamilton (Chicago) tickets from the official profhimservice53.ru site. Find point. Even though I have seen it twice in Chicago I will go to see it. There are many ways to get tickets to Hamilton on Broadway and as ticket prices span a wide range (from $10 for the popular lottery tickets, all the way to. Hamilton - Pittsburgh | Official Ticket Source | Benedum Center | Wed, Sep 11 - Sun, Sep 29, | @CulturalTrust | PNC Broadway in Pittsburgh. Ticket prices range from around $ to $, depending on performance time and availability. What are the most expensive tickets for Hamilton on Broadway? Select your event date and price range to find the best tickets from Front Row Seats at the best prices. Price Range: The Box Office is closed for in-person ticket sales and on concert day/night. Keep up to date. Join the HPO mailing list. Connect with us. Hamilton on Broadway · See it This Week · Last-minute tickets are available for all performances $$ (inclusive of handling fees). You can buy Hamilton front row tickets to their concert for between $ and $ They typically range between $$ each if they are offered. Find out more about the events at Saenger Theatre and buy tickets directly from the official box office. Get the best deals on plays, musicals and shows. Buy Hamilton (Chicago) tickets from the official profhimservice53.ru site. Find point. Even though I have seen it twice in Chicago I will go to see it. There are many ways to get tickets to Hamilton on Broadway and as ticket prices span a wide range (from $10 for the popular lottery tickets, all the way to. Hamilton - Pittsburgh | Official Ticket Source | Benedum Center | Wed, Sep 11 - Sun, Sep 29, | @CulturalTrust | PNC Broadway in Pittsburgh. Ticket prices range from around $ to $, depending on performance time and availability. What are the most expensive tickets for Hamilton on Broadway?

Get the best deals and cheapest Hamilton tickets on TickPick. % authentic tickets with absolutely no fees ever. Period. tickets June , based on availability. What are the ticket prices? When tickets go on sale on July 9, prices will range from $49 to $ with a select. We offer a range of discounts and concessions to enable everyone to enjoy £5 off standard price tickets in all seating areas. 2 for 1 for disabled. The easiest way to purchase tickets in advance is online through our website. There is a small service fee, depending on ticket price. Tickets are available at. Currently, Hamilton musical tickets at Vivid Seats start at $ The median price for all Hamilton tickets nationwide is currently $ How to Get All Broadway Shows · Wicked. Meet the witches of Oz before Dorothy dropped in. · The Lion King. Pride Rock comes to life in Disney's long-running hit. · Hamilton. Broadway shows offer tickets at many different price points. Regular Price tickets generally range from $20 to $ You can expect to pay higher prices for. Look at the seats available for your dates and see what's in your price range. Front orchestra seats will be much more expensive than balcony. How much do tickets cost and how many can I purchase? At on sale, ticket prices will range from $49 - $, with a select number of premium seats available from. Tickets range $$ for regular performances with select number of premium seats available for all performances and some increased pricing during the. In general, you can find Hamilton New York tickets as low as $ with an average price of $ How to get cheap Hamilton New York tickets? There's a few. Upcoming Hamilton Broadway Tickets ; Tuesday Sep 10, · from $ ; Wednesday Sep 11, · from $ ; Thursday Sep 12, · from $ ; Friday Sep Ticket prices range from $59 to $, subject to change. Where can I purchase tickets? Tickets will be available for purchase here on this page or by calling . How to Buy Tickets · Lee® Wrangler® Lounge · Important Ticketing Notice · Enhance Broadway shows will offer a varied range of entertainment that could. Discover Hamilton's Best Concerts on October 6. Find shows, buy tickets, check seating charts, plan where to eat and how to get there. Ticket prices for the musical Hamilton start at $ (NYC), in Chicago from $ Look at this website for details. Continue Reading. When tickets go on sale, prices will range from $49 to $ with VIP seats at $ for select performances. Tickets for Hamilton will not be mailed and print. Spread the cost of tickets with Pay in Instalments. Purple letter A We are offering a range of hospitality options for Hamilton shows, so that you. Hamilton tickets can range in price depending on where you want to sit. Do you want to be up close and personal? Do you want a front row seat or club seats? How much are Hamilton tickets? Ticket prices typically range from £25 to £ depending on performance dates and availability. What are the most expensive.